Minimum Wage, Statutory Pay and Deduction Thresholds 2024-25

Minimum Wage, Statutory Pay and Deduction Thresholds 2024-25

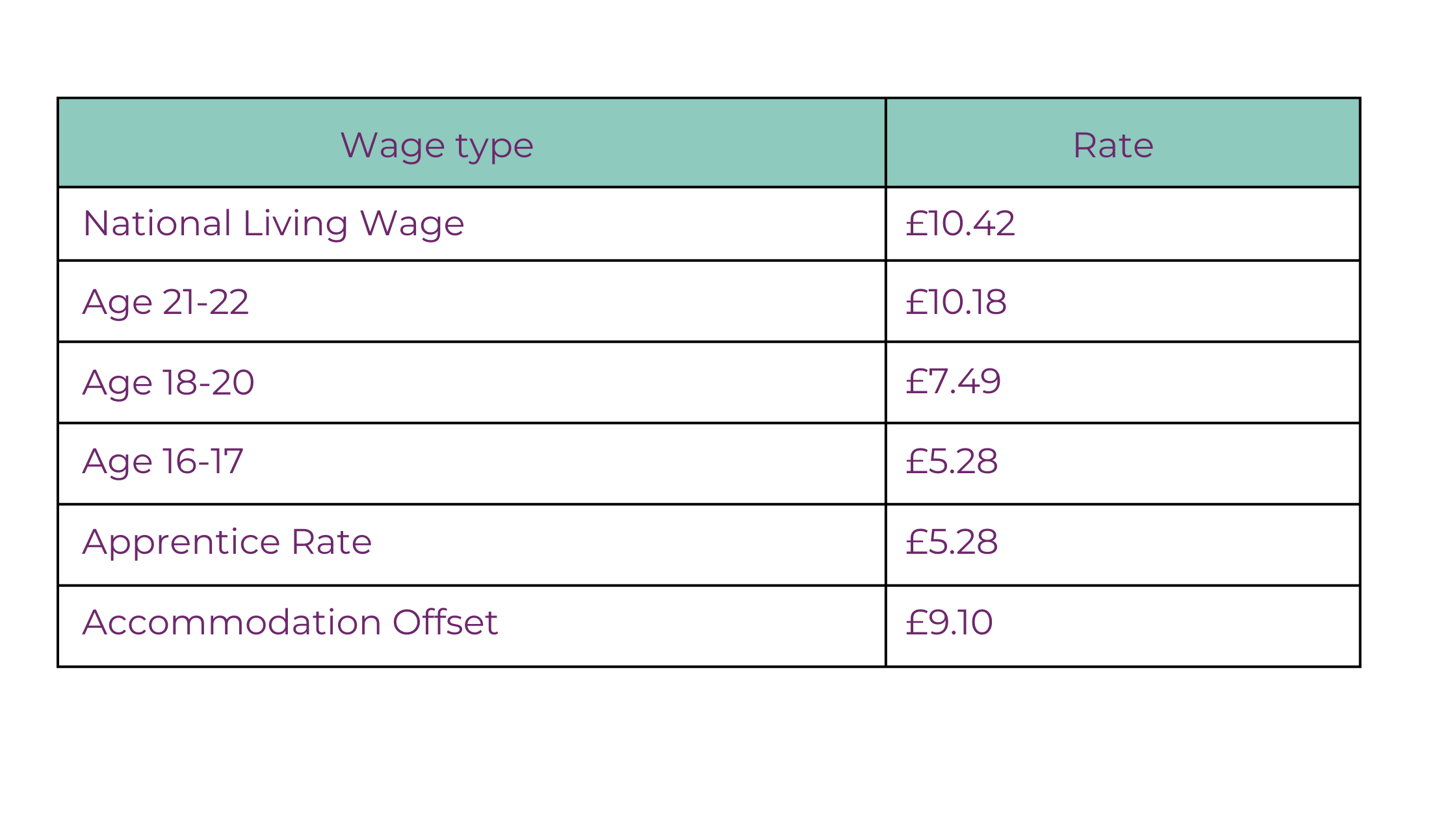

Minimum wage rates change on 1st April each year so it’s vitally important you are aware of the new rates and ensure you have checked your payroll software is up to date to ensure wages are calculated using the correct rates.

The hourly rate for the minimum wage depends on age and whether you are an apprentice. You must be at least:

- school leaving age to get the National Minimum Wage

- From 1 April 2024, workers aged 21 and over will be entitled to the National Living Wage – the minimum wage apply for workers aged 20 and under

Minimum Wage

| Rate from 1 April 2023 | Rate from 1 April 2024 | Increase | |

| National Living Wage (NLW) for workers 21 and over |

£10.42 | £11.44 | 9.8% |

| 18-20 year old rate (NMW) | £7.49 | £8.60 | 14.8% |

| 16-17 year old rate (NMW) | £5.28 | £6.40 | 21.2% |

| Apprentice rate | £5.28 | £6.40 | 21.2% |

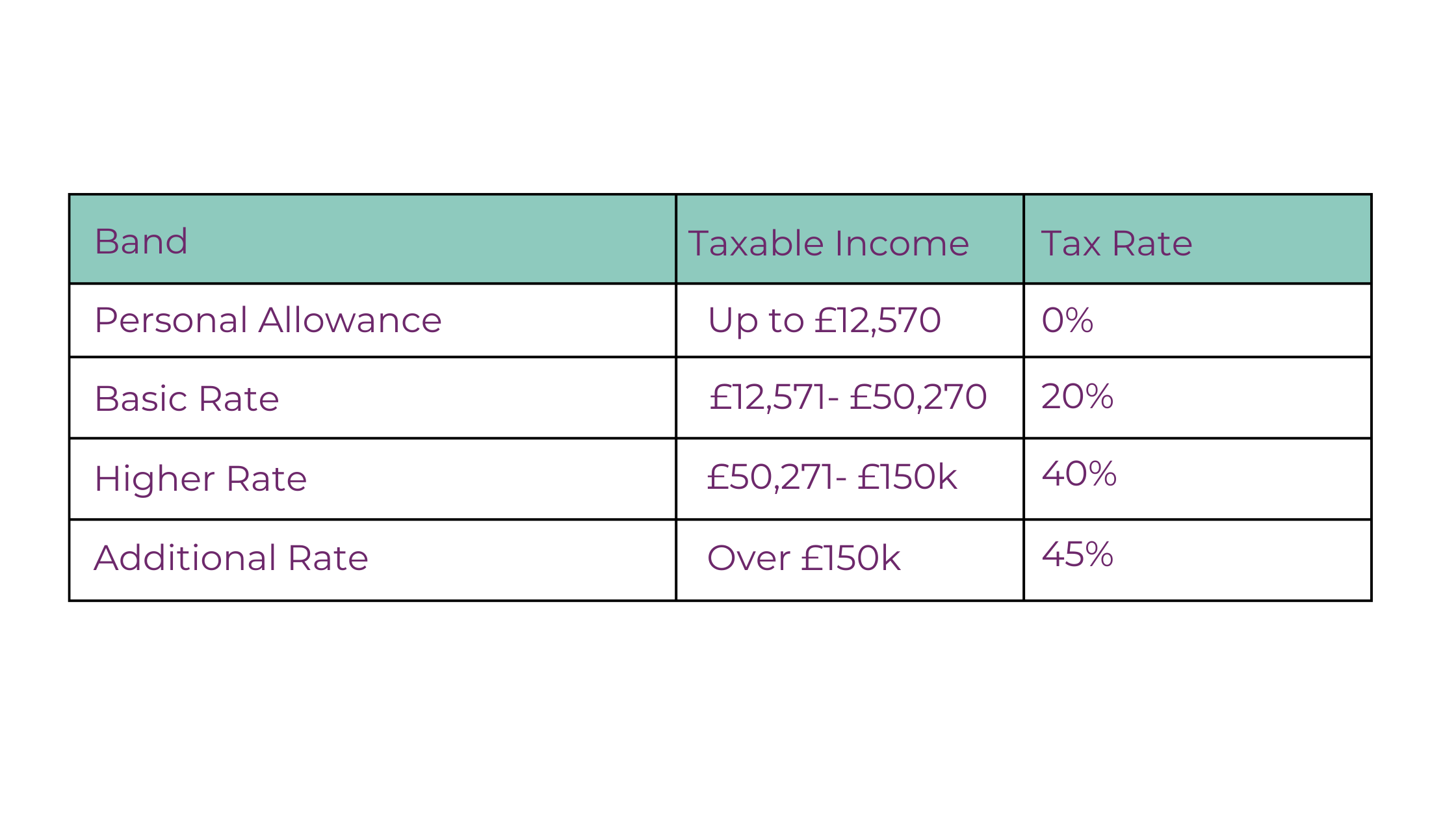

Personal Allowance & Income Tax

The amount of Income Tax you need to deduct from your employees’ wages depends on how much they earn and how much of their taxable income is above their personal allowance and which tax band it falls into.

- Personal Allowance: 0% tax on earning up to £12,570.

- The standard tax code is 1257L.

- 20% tax is due on earnings between £12,571 and £50,270.

- 40% tax is due on earnings between £50,271 and £125,140.

- 45% tax is due on earnings more than £125,140.

Emergency tax codes from 6th April 2024 are as follows:

- 1257L W1

- 1257L M1

- 1257L X

Statutory Pay Rates

From 6th April 2024 Statutory Sick Pay (SSP) is £116.75 per week, with the amount due based on the number of working days in the week.

From 7th April 2024 the following statutory payments increase to £184.01 per week or 90% of average weekly earnings (AWE), whichever is the lower:

- Statutory Maternity/Adoption Pay – eligible employees will receive up to 39 weeks of SMP/SAP at 90% of their average weekly earnings before tax – for the first 6 weeks of their leave, followed by £184.03 or 90% of their average weekly earnings (whichever is lower) – for the remaining 33 weeks of their leave.

- Statutory Paternity Pay

- Statutory Shared Parental Pay

- Statutory Adoption Pay

- Statutory Bereavement Pay

For further information about payroll rates for 2024-2025 visit the government website

National Minimum Wage and National Living Wage rates – GOV.UK (www.gov.uk)

Running your own payroll can be tricky, especially as you have to be sure you’re paying both your employees and HMRC the correct amount. If you’re worried about running payroll, why not outsource? We can take the stress away of payment deadlines and you can be sure you’re paying both your employees and HMRC correctly.

ABOUT SUE

Sue Haynes is the founder of Cactus Bookkeeping and helps business owners

with all aspects of Bookkeeping to save them time so they can concentrate on running their

business. Sue is licensed, regulated and supported by the Institute of Certified Bookkeepers (ICB)

Recent Comments